Oct. 23, 2012 About three years ago, discussion on Financial Capitalism and

Democracy on WAIS was summarized in one post

re: Capitalism and Democracy (Oct. 18, 2009)

(“Perfect Storm Syndrome” was originally e-mailed on June 3, 2005)

Excerpt: “Bienvenido Macario (BM): I’m not sure if the major players in the (US) financial system support the Bush and Obama administrations’ efforts to compel China to properly price their undervalued Yuan against the US dollar, among other currencies. Whether these players were also in favor of a “strong dollar” that both the Bush administration and Treasury Sec. Geithner were seeking is not clear. As of last week the US Treasury quietly abandoned the pursuit of a “strong dollar” and the stock market rose.

I am not in favor of a weak US Dollar, but currencies and liquids behave exactly the same: water seeks its own level. The components of the Perfect Storm Syndrome-Global Edition are:

The components of the “Perfect Storm Syndrome – Global Edition” are:

1.) High oil prices;

2.) High interest rates &

3.) A strong dollar / Strong currency (currency wars / worries).

While the Domestic Components of the “Perfect Storm Contagion” are:

1.) Health care (high costs);

2.) Retirement/pension (lack thereof) &

3.) Education (this is the biggest challenge of all as the strong dollar is in the global edition).

In my opinion, the root cause of the present financial crisis, in one word, is “globalization.” I have never seen any financial analyst offer an assessment on the financial market status from a global perspective. They all offer observations from the G-7 perspective, as if the rest of the G-20 nations do not count.

In 2002 in the aftermath of Enron, Paul Volcker made very sensible suggestions but the US Congress decided to “perform for the media and their constituents” and enacted the Sarbanes-Oxley instead. Of course we all know what Bernie Madoff did. And so with SOX notwithstanding, how come Bernie Madoff managed to pull a huge ponzi scheme?

From: re: Capitalism and Democracy (Bienvenido Macario, Philippines/US) 10/18/09 7:36 pm

https://waisworld.org/go.jsp?id=02a&objectType=post&o=45697&objectTypeId=39947&topicId=92

My understanding is that a sitting Fed Reserve Chairman could not or should not give direct advice to the private sector on how to conduct their businesses as this will violate the fundamental principle of free enterprise or Laissez faire.

Whether it is for the economy’s good or not, the government should not intervene with private sector’s business. And the Fed Reserve bank is a government entity. Hence Greenspan had to master the Fed speak.

This is the niche market I would like to get in.

CNBC EXCLUSIVE: CNBC MEDIA ALERT: CNBC’S STEVE LIESMAN SITS DOWN ONE-ON-ONE WITH DR. ALAN GREENSPAN, FORMER FEDERAL RESERVE CHAIRMAN AND GREENSPAN ASSOCIATES LLC PRESIDENT, TOMORROW ON CNBC’S “POWER LUNCH”

Published: Monday, 22 Oct 2012 | 4:22 PM ET Text Size

By: Jennifer Dauble

http://www.cnbc.com/id/49453748

WHEN: TOMORROW, TUESDAY, OCTOBER 23RD AT 1:30PM ET

WHERE: CNBC’S “POWER LUNCH”

In a CNBC EXCLUSIVE interview, CNBC’s Steve Liesman sits down one-on-one with Dr. Alan Greenspan, Former Federal Reserve Chairman and Greenspan Associates LLC President, tomorrow, Tuesday, October 23rd at 1:30PM ET on CNBC’s “Power Lunch.”

====================================

More to come.

Ned Macario

Lemuria

Ancora Imparo

IGA

re: Capitalism and Democracy (Bienvenido Macario, Philippines/US)

Posted on October 18th, 2009

http://waisworld.org/go.jsp?id=02a0&objectType=post&objectTypeId=39947&topicId=92

Bienvenido Macario (BM) responds to Tor Guimaraes (TG)’s post of 17 October:

TG: In 1999 a partner and I presented a paper at an international meeting in Atlanta describing how the economic system was dominating the social/political system, and how the financial system, in turn, was dominating the economic system.

BM: The way I see it, the economy is dominated by the sociopolitical system, which in turn is dominated by the financial system like lobbying, campaign finance, funding of media blitz and infomercials. The financial system is now in crisis for lack of cash and credit in all sectors of society.

TG: The amazing thing is that major players in the financial system are now so powerful to openly control any attempts by the US Congress to produce legislation curbing the very excesses which led to the present crisis and the shocking bailout of the financial system by American taxpayers.

BM: I’m not sure if the major players in the (US) financial system support the Bush and Obama administrations’ efforts to compel China to properly price their undervalued Yuan against the US dollar, among other currencies. Whether these players were also in favor of a “strong dollar” that both the Bush administration and Treasury Sec. Geithner were seeking is not clear. As of last week the US Treasury quietly abandoned the pursuit of a “strong dollar” and the stock market rose.

I am not in favor of a weak US Dollar, but currencies and liquids behave exactly the same: water seeks its own level. The components of the Perfect Storm Syndrome-Global Edition are: High oil prices; high interest rates (coming soon to a mortgage near you) and a strong dollar. While the domestic components of the Perfect Storm contagion are: health care (high costs); retirement/pension (lack thereof) and education (this is the biggest challenge of all as the strong dollar is in the global edition).

While Geithner is talking about wanting to see a strong US dollar, I do not see any concrete steps to convince anyone that the US dollar should be taken seriously (strong). The US Treasury Secretary cannot just say “I want a strong US dollar” and the rest of the world will react with reverence and treat the US dollar as strong. It should be the result of new policy or amendments to existing policies and the resulting reaction from America’s major trading partners.

In my opinion, the root cause of the present financial crisis, in one word, is “globalization.” I have never seen any financial analyst offer an assessment on the financial market status from a global perspective. They all offer observations from the G-7 perspective, as if the rest of the G-20 nations do not count.

In 2002 in the aftermath of Enron, Paul Volcker made very sensible suggestions but the US Congress decided to “perform for the media and their constituents” and enacted the Sarbanes-Oxley instead. Of course we all know what Bernie Madoff did. And so with SOX notwithstanding, how come Bernie Madoff managed to pull a huge ponzi scheme?

TG: Under Bush and Obama, trillions of taxpayer dollars have now been used to save the major icons of capitalism (the big banks and other financial institutions) from self destruction due to their own fraudulent behavior.

Goldman Sachs reported allocating $16.7 billion so far this year for employee compensation, an average of $530,000 per employee, while American unemployment is close to 10 percent.

BM: During the times of growth and expansion, the private sector should also credited with bringing prosperity to the country and around the world, not just the US Congress and the Federal Reserve Bank. Banks and financial institutions provided jobs, payroll taxes, paid corporate income taxes and lobbied hard as well. The government should bail them out if need be to avoid the collapse of our financial system.

Investment banks like Morgan Stanley, JP Morgan-Chase and Merrill Lynch are all having a heck of a time trying to compete with the “Wal-Mart” of investment bankers, Goldman Sachs. (Do these investment bankers want some ideas how to beat Goldman Sachs? It could be very difficult but not impossible. But what are they willing to give me?)

Just because there is a financial crisis, employees of firms that perform well should not be punished. They should be rewarded. Why is the government not forcing Wal-Mart to share its corporate secret with other retailers? Why punish Goldman Sachs for being the one successful investment banker during this marathon recession? When was the US Congress punished for passing bad laws like Sarbanes Oxley Act of 2002 and the Oct . 2008 bailout law? Is this democracy?

What if America’s big banks and financial institutions were to seek the IMF-World Bank-UN immunity from any responsibility or accountability? What if these banks and institutions would refuse to go to business unless they also are granted the same immunity as that of the IMF, World Bank, UN, OECD, Asian Development Bank and such?

TG: The financial industry spent $224 million dollars in the first half of this year alone to lobby Congress. The banks own Congress. The House Financial Services Committee has received more than $6 million dollars for its members in 2009, with 27 of the committee’s 71 members receiving more than 25 percent of their total political contributions from the financial industry.

BM: This is exactly my point above. The financial system controls the social/political system which in turn controls the economic system. Which branch of the government effectively checks the US Congress?

JE comments: What are Bienvenido Macario’s suggestions for competing with Goldman Sachs? Who’s left to compete with them anyway? I don’t have much to offer by way of compensation for Bienvenido’s ideas, but I could send him a few leftover “Pax et Lux” WAIS pens…they are most useful for winning friends and influencing people.

Note to WAISers: I deserve credit for not rising to Bienvenido’s bait on Wal-Mart.

–

For information about the World Association of International Studies (WAIS), and its online publication, the World Affairs Report, read its homepage by simply double-clicking on: http://wais.stanford.edu/

John Eipper, Editor-in-Chief, Adrian College, MI 49221 USA

Academic WAR Forums capitalism and democracy

ADDITIONAL WAIS POSTS ON STRONG CURRENCY:

Excerpts from relevant WAIS posts on Currency Wars (strong/weak dollar):

A.) Global Consequences of a Greek Default (Bienvenido Macario, ,06/22/11

“There’s a lot of uncertainty with how the European debt crisis will play out. How the next IMF Director will handle the debt crisis in Europe is one factor. The two leading candidates for IMF Chief will meet with the executive board this week. Mexico’s Agustín Carstens met with Treasury Secretary Tim Geithner, while France’s Christine Lagarde will meet Geithner this week.

I’m curious as to why the IMF candidates are not meeting with former No. 2 persons of IMF like Stanley Fischer? I think they should meet with former Federal Reserve chairmen Paul Volcker, Alan Greenspan, incumbent Ben Bernanke and the US Treasury Secretary Tim Geithner.

It doesn’t make sense to meet with Tim Geithner, who may or may not be there after 2012. He is not with the US Central Bank (Federal Reserve Bank).

From: Global Consequences of a Greek Default (Bienvenido Macario, , 06/22/11 5:08 am) http://waisworld.org/go.jsp?id=02a&objectType=post&o=65900&objectTypeId=60150&topicId=198

============================

C.) re: US: Obama One Year after Elections (Bienvenido Macario,) 11/06/09

“Pres. Obama should be credited with stopping the recession but at the cost of making Washington DC the new financial capital of the US and at the expense of Wall St. Nothing really wrong there, except the US is has a market-based economy. When the financial and political capital of a country is one and the same there will soon be an inefficient economy.

Now who will lobby for the entire US economy? Fannie Mae, Freddie Mac, World Bank and the IMF are the worst examples of “too big to fail, too big to be wrong” corporations and institutions.

Treasury Secretary Tim Geithner is like a typical Filipino politician, who says one thing and does the opposite. He speaks of “strengthening the US Dollar” and then throws away billions of taxpayer money on hopeless cases like the “Gang of Four” (IMF, World Bank, Fannie and Freddie). He should explain this conflict between his goals and policies to US taxpayers. He should answer to his employer, the American people.

JE comments: I went to college with Timothy Geithner (he graduated three years before me; we never met). Tim: if you’re reading these lines, I vote for a strong dollar! And Go Green!

Bienvenido Macario writes that national economies become inefficient when their political and financial capitals are one and the same. This is the rule for the overwhelming majority of countries–Russia, France, Japan, Mexico, the UK. In Europe, Germany and Switzerland are the only two countries with separate financial and political capitals.

Elsewhere in the world, we have the examples of Australia, Brazil, (possibly) China, India, and the US. Does either model necessarily lead to inefficiency? New York City, interestingly enough, isn’t the political capital of anything–not even the state of NY. But New Yorkers will be quick to tell you they are the center of the universe.

From: re: US: Obama One Year after Elections (Bienvenido Macario, Philippines/US) Fri, Nov 6, 2009 at 2:05 AM

http://waisworld.org/go.jsp?id=02a&objectType=post&o=46195&objectTypeId=40445&topicId=44

============================

The First Perfect Storm Over Europe Impact Date Sept. 28, 2007.

May 31, 2014

The WAIS discussion on the results of the recent EU parliamentary elections could be traced to Richard Hancock’s post of June 2, 2007. See: Books: *The Last Days of Europe* by Walter Laqueur (Richard Hancock, US, 06/02/07 7:53 am) http://waisworld.org/go.jspid=02a&objectType=post&o=15557&objectTypeId=9807&topicId=1

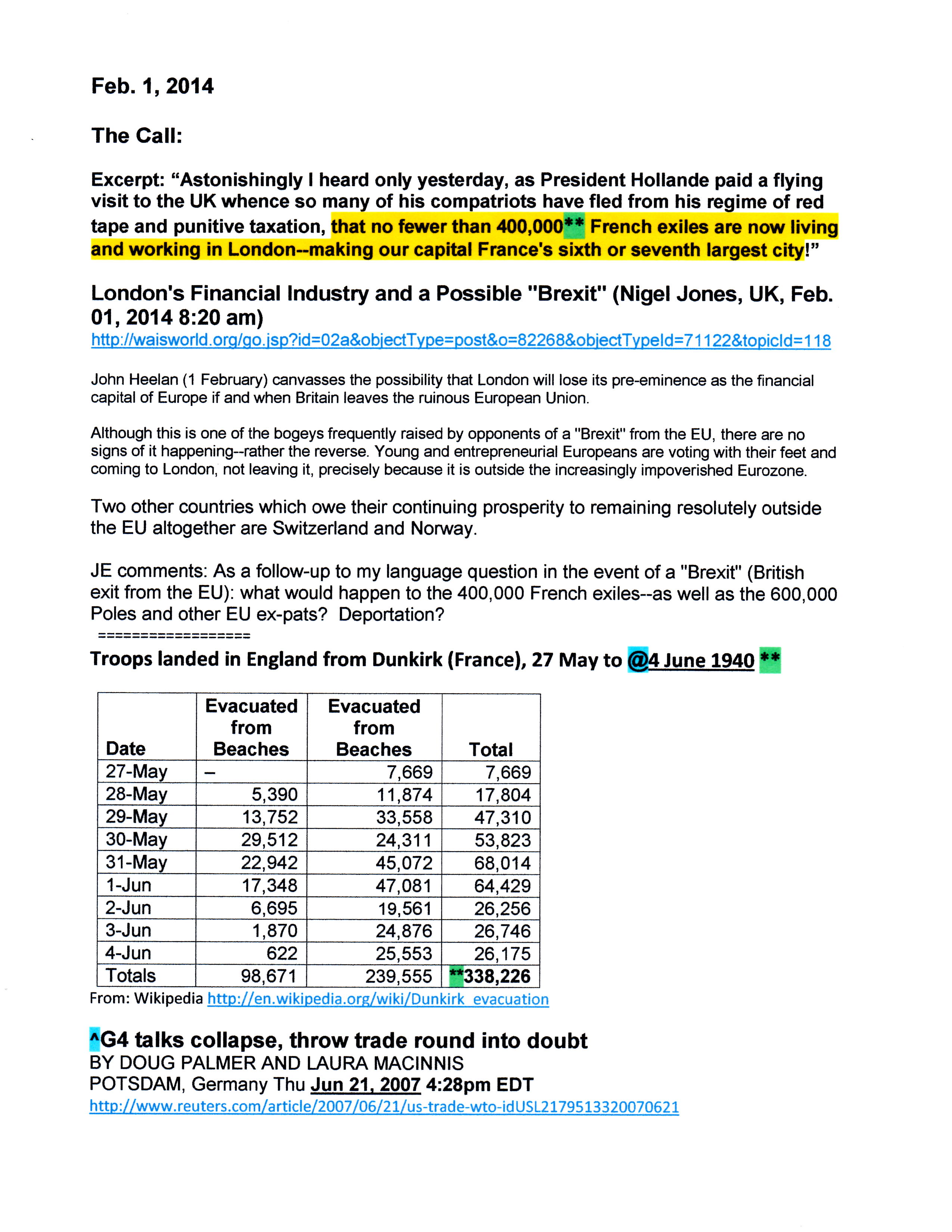

In one of my June 4, 2007 e-mail comments I compared this period prior to the 2007 Perfect Storm to the “Miracle of Dunkirk” in 1940. The scenario is similar after the Dunkirk evacuation, as in after Tony Blair leaves 10 Downing Street. Gordon Brown is also from the Labor Party. It will take a conservative like David Cameron to create the safe haven in London where the French free marketeers would seek refuge.

Other comments were:

– Actually the best time to write this (forecast/prediction) is on June 21, 2007 by then at least one more news story would be out and this discussion would be more relevant. (See last news article. The impact date of Friday, Sept. 28, 2007 was made and stated on June 4, 2007 e-mail.

The 2007 Perfect Storm Over Europe & Financial Dunkirk is in fact nothing more than a prediction when the subprime mortgage crisis that started in the U.S. on Mar. 15, 2007 will impact Europe. (See: Real Estate Forecast 15 Dec. 2006 Impact date: 15 March 2007 ( https://www.nedmacario.us/real-estate-forecast-15-dec-2006-impact-date-15-march-2007/ )