Real Estate Forecast Dec. 15, 2006 impact date: Mar. 15, 2007

FAST FORWARD TO MARCH 15, 2007

Originally Posted on

Besides, even though the UK does not have Fannie Mae and Freddie Mac, the housing market is expected to be problematic as indicated by this 01/26/12 news below:

Housing market ‘to remain subdued’ 01-26-12

UKPA) – 2 hours ago Thursday, January 26, 2012

http://money.aol.co.uk/2012/

A “generational divide” in the property market is likely to cause further subdued sales this year, with young people unable to buy and older home owners unwilling to sell, a study has found.

One in 10 Britons would consider moving home or trying to get on the housing ladder in the next six months, the HSBC Moving Home Survey said.

==============================

E-mail forecast via Yahoo News Story: Real estate expected to flounder in 2007 dated 15 Dec. 2006

Date: 15 Dec 2006 11:08:46 -0800

From: “Bienvenido Macario” <laspinassja@yahoo.com>

To: wais@adrian.edu, ned.macario@gmail.com

CC: laspinassja@yahoo.com

Subject: Yahoo! News Story – Real estate expected to flounder in 2007 – Yahoo! News

Bienvenido Macario (laspinassja@yahoo.com) has sent you a news article.

(Email address has not been verified.)

——————————

Personal message:

If you have a house and a mortgage, this is one e-mail you cannot afford NOT to read.

December 15, 2006

NOTE TO SELF – MORTGAGE AND REAL ESTATE

Excerpt: “If you would go back to Alan Greenspan’s speeches, he sounded the alarm bells back in 2005 when he expressed concern about (the) exposing the bigger portion of Fannie Mae’s and Freddie Mac’s real estate portfolios to high risk and creative products.

This is what he was talking about.

The effects of this PORTION of the perfect storm will manifest itself by March 15, 2007*.

There are always solutions.”

=== end of email excerpt =======

FAST FORWARD TO MARCH 15, 2007

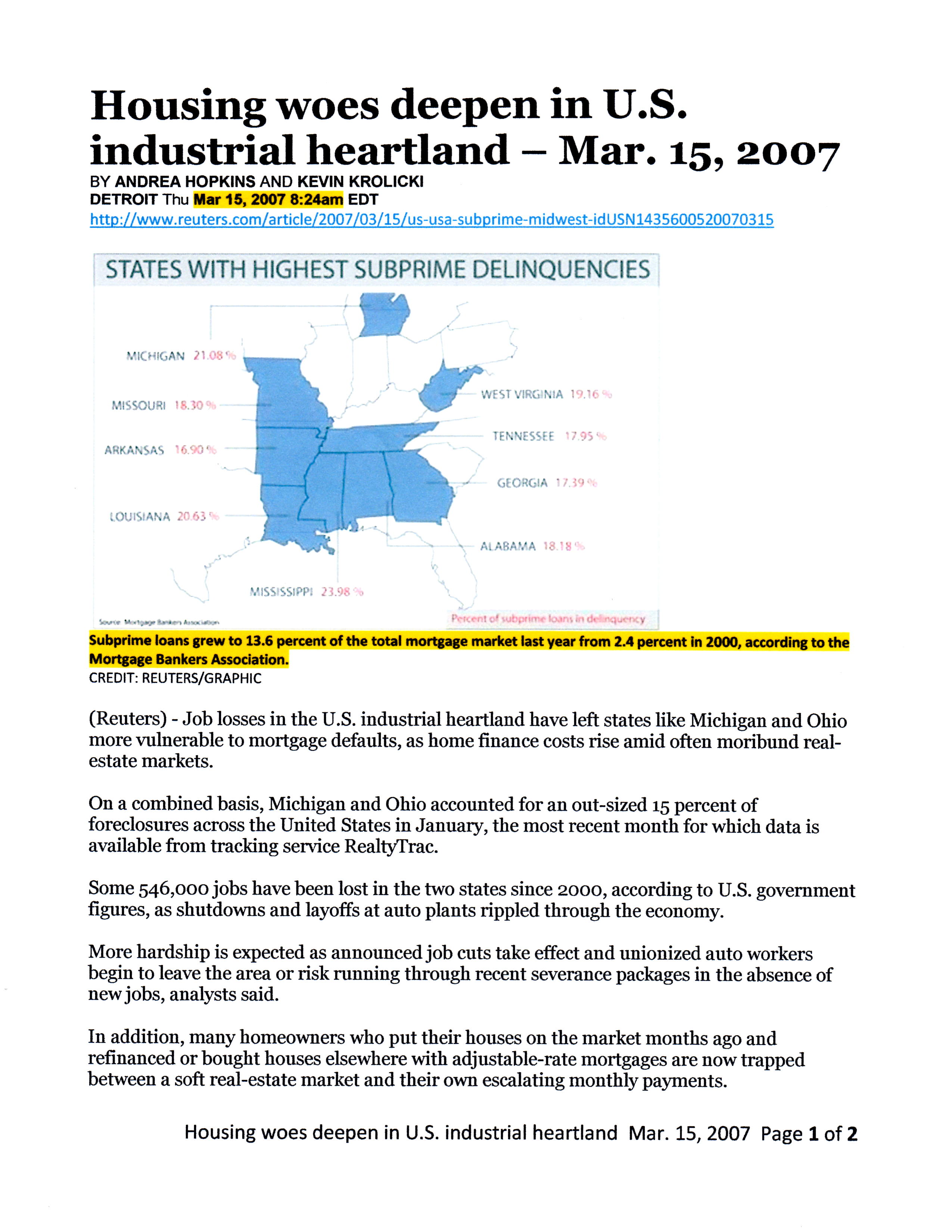

Housing woes deepen in U.S. industrial heartland

By Andrea Hopkins and Kevin Krolicki Thu Mar 15, 2007* 6:46 AM ET

http://news.yahoo.com/s/nm/

DETROIT (Reuters) – Job losses in the U.S. industrial heartland have left states like Michigan and Ohio more vulnerable to mortgage defaults, as home finance costs rise amid often moribund real-estate markets.

On a combined basis, Michigan and Ohio accounted for an out-sized 15 percent of foreclosures across the United States in January, the most recent month for which data is available from tracking service RealtyTrac.

==============================

Ned Macario

Lemuria

Ancora Imparo

IGA

2008 Update: Zero Sum Game of Global Finance – 3rd Edition Oct. 7, 2008