Friday, Nov. 16, 2012 – First, below is the original Paper No. VIII (Note to Self) highlighted are the three industries were featured in the news: 3.) Entertainment (Recording and Movie Industries); 4.) Groceries / Supermarkets (Food); 7.) Technology or Silicon Valley

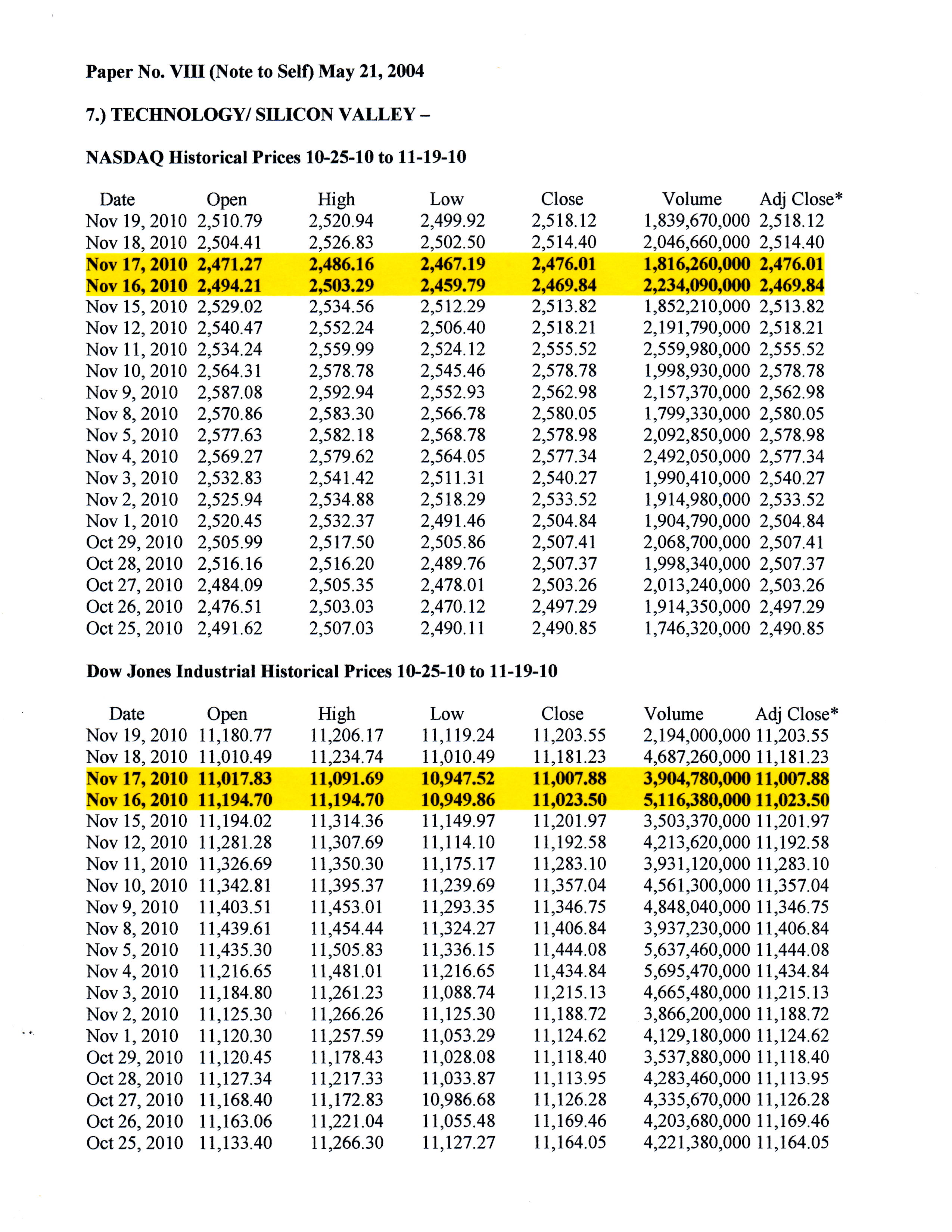

Tuesday, Nov. 16, 2010 Update on 7.) Technology or Silicon Valley: “NASDAQ at 2,500 would be an ideal staging ground to sustain a rally and break the 11,000 mark.“

Friday, Nov. 16, 2012 – On this day three industries were featured in the news:3.) Entertainment (Recording and Movie Industries) 4.) Groceries / Supermarkets (Food) 7.) Technology or Silicon Valley.

Thursday Nov. 15, 2012 8:00 am PST is 12:00 am Friday Nov. 16, 2012 in Manila, Philippines. On this day two industries were featured in the news: 5.) Banking and again 7.) Technology or Silicon Valley.

In 2005 & 2006 there were the following updates on 3.) Entertainment (Recording and Movie Industries)

=======================

December 13, 2012

As of Nov. 16, 2012 the cycle was completed with an update on no. 7 Technology. This means it’s back to no. 1 Publishing: Here’s the update:

Buffett is latest billionaire to struggle with newspaper revival EDMUND LEE , BLOOMBERG NEWS NEW YORK THURSDAY 13 DECEMBER 2012 http://www.independent.co.uk/news/world/americas/buffett-is-latest-billionaire-to-struggle-with-newspaper-revival-8412323.htmlWarren Buffett, the investor famous for betting on aging industries like railroads and insurance, is now trying to pull off something other billionaires have tried and failed to do: save the newspaper business. His company, Berkshire Hathaway, has spent more than $342 million on 80 newspapers — including its hometown paper, the Omaha World-Herald — and used them to build a new business unit. And Buffett isn’t done. Though the division announced plans to close an underperforming newspaper in Virginia last month, he’s said that more acquisitions may be in store.

============================

NEWS UPDATE for Friday, Nov. 16, 2012

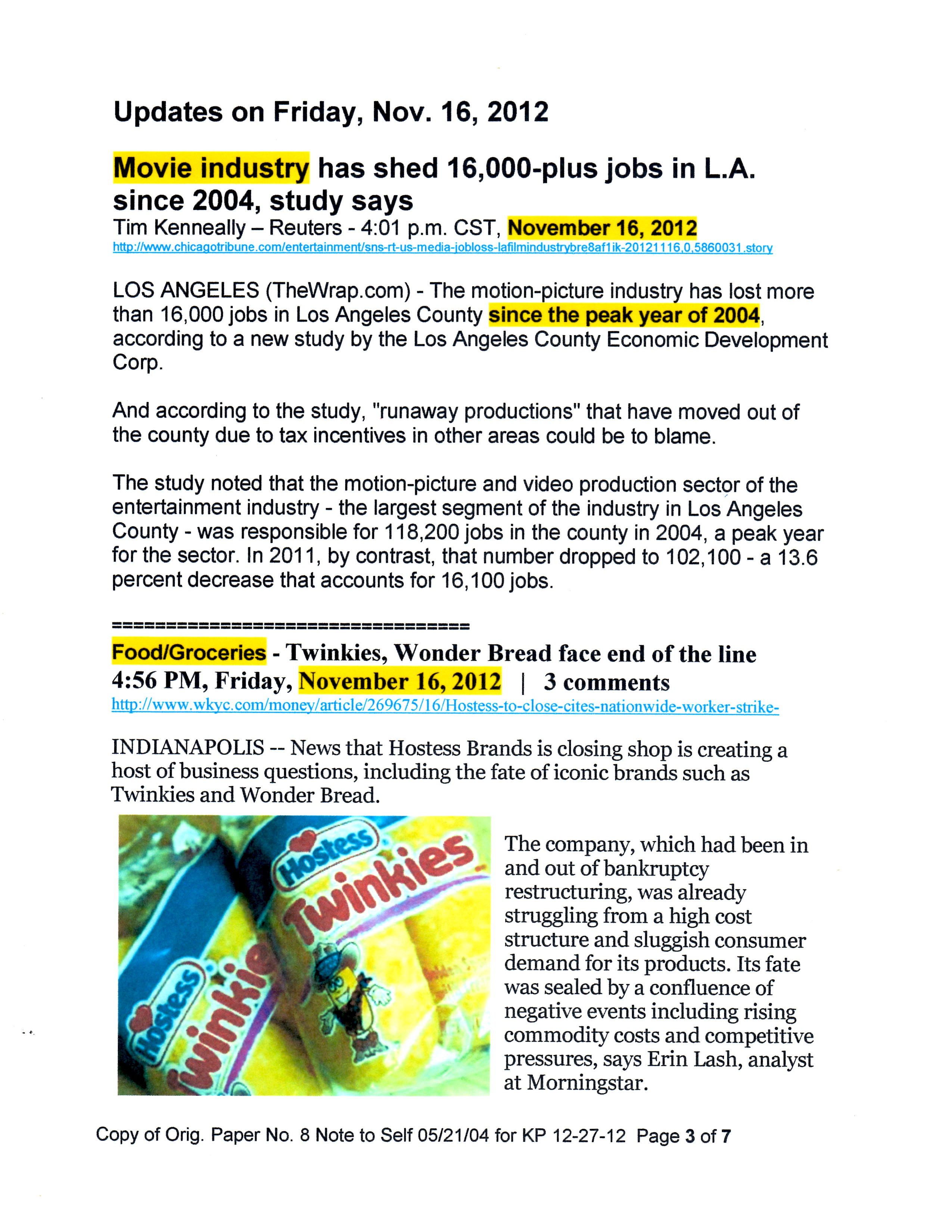

3.) Entertainment (Recording and Movie Industries) – This is a tricky one because analyst tend to blame piracy and intellectual property rights violations as the culprit in the loss of market sales that could go anywhere from 18% to 26% relative to population growth. It seems (to analyst) that some 18% suddenly “stopped going movies”.

NEWS UPDATE for Friday, Nov. 16, 2012

INDIVIDUAL ARTICLES (3)

4.) Groceries / Supermarkets– the latest strike of food clerk union was inevitable. In fact health care cost (& other Perfect Storm Components) induced walkouts will occur every 3 years on the average. This will spill over to other uniionized industries like telecommunications.

5.) Banking – The S & L industry and other financial services have lost a major share of their traditional market and it seems they didn’t even realize it. The business landscape has changed a bit slowly such that these banks could no longer compete in their own backyard. The business landscape mutated rather than evolved to something where S & L banks are forced to compete against highly seasoned counterparts in the financial services in a new field – Mutual fund.

6.) Investments and Finance – Although traditional mutual fund companies have a decided edge over the mutual fund operations of banks, the industry its has recently been losing out to the relatively unregulated hedge funds and currency traders while at the same time being pestered by day traders. Competition is so tough that the temptation to “misbehave” have landed several firms in trouble and fine is not the only penalty in some cases.

7.) Technology or Silicon Valley – nudging this industry a bit is important because the stock market and the economy could not sustain a rally and break the 11,000 mark. Dow could have move beyond the 11,000 in March but I am not yet involved in any of this industries. NASDAQ at 2,500 would be an ideal staging ground to sustain a rally and break the 11,000 mark.

=============================

UPDATE THURSDAY, NOVEMBER 15 & 16, 2012

Panasonic to cut 10,000 jobsBy Indo Asian News Service | IANS – Fri, Nov 16, 2012 http://en-maktoob.news.yahoo.com/panasonic-cut-10-000-jobs-052819109.html Tokyo, Nov 16 (IANS/EFE) Electronics giant Panasonic plans to eliminate an additional 10,000 jobs by next spring, most of them at units outside Japan, company executives said. Japan’s leading commercial employer slashed 36,000 positions in 2011. The bulk of the new cuts will come at overseas units of Panasonic’s Sanyo subsidiary, the executives told the Kyodo news agency, adding that the company hopes to sell some business units and will close others. Panasonic included the estimated cost of the layoffs in its profit estimate for the current fiscal year, which ends March 31, 2013. The company is forecasting a net loss of nearly $10 billion for the fiscal year after losing around $8.5 billion between April 1 and Sep 30, a five−fold increase over the same period in 2011. The chief financial officer of the Panasonic group, Hideaki Kawai, said he hopes to reduce the enterprise’s net debt to zero by March 2015, business daily Nikkei reported Thursday. Panasonic, with a total payroll of around 300,000 has been hurt by weak sales of its television, computers and cell phones. −−IANS/EFE Rd

======================

6.) Investments and Finance – Although traditional mutual fund companies have a decided edge over the mutual fund operations of banks, the industry its has recently been losing out to the relatively unregulated hedge funds and currency traders while at the same time being pestered by day traders. Competition is so tough that the temptation to “misbehave” have landed several firms in trouble and fine is not the only penalty in some cases.

=====================

News updates – Oct. 25, 2012

EU Debt Crisis: Auto: Ford Closing 3 Plants In European Downsizing

By BILL VLASIC and DAVID JOLLY

Published: October 25, 2012

The Ford Motor Company has broken from the pack of troubled European automakers, announcing deep cuts that include shutting three factories in the region and eliminating 5,700 jobs.

Retail: Amazon reports first quarterly net loss in years

Reuters – 1 hour 43 minutes ago Thursday, October 25, 2012

http://finance.yahoo.com/news/amazon-reports-big-quarterly-net-201043157.html

SAN FRANCISCO (Reuters) – Amazon.com Inc reported its first quarterly net loss in more than five years on Thursday as the world’s largest Internet retailer spent heavily and suffered from an economic slowdown in Europe.

======================

Investments: KKR Said to Struggle With $8 Billion Goal for LBO Fund

By Anne-Sylvaine Chassany and Cristina Alesci – Oct 25, 2012 3:03 PM PT

http://www.bloomberg.com/news/2012-10-25/kkr-said-to-struggle-with-8-billion-goal-for-lbo-fund.html

KKR (KKR) & Co. co-founders Henry Kravis and George Roberts are struggling to wrap up their first main buyout fund in six years as the firm’s prior fund underperforms and investors scale back private-equity commitments.

KKR has gathered less than $6.5 billion for North America XI Fund, including less than $1 billion since February, according to a person with knowledge of the matter. New York- based KKR, which began marketing the fund at the start of 2011, is seeking $8 billion, about half the size of its 2006 pool.

=============================

7.) Technology or Silicon Valley – nudging this industry a bit is important because the stock market and the economy could not sustain a rally and break the 11,000 mark. Dow could have move beyond the 11,000 in March but I am not yet involved in any of this industries. NASDAQ at 2,500 would be an ideal staging ground to sustain a rally and for Dow to break the 11,000 mark.

=============================

UPDATE Friday, October 26, 2012

Technology: Apple misses 4th-quarter estimates 10-26-12

Investors are disappointed as the tech giant, which posted a 24% rise in profit, sells fewer iPads than anticipated.

By Andrea Chang, Los Angeles Times October 26, 2012

http://www.latimes.com/business/la-fi-apple-earnings-20121026,0,2324798.story

==============

UPDATE: Mon. Oct. 25, 2010 to Nov. 19, 2010 DOW & NASDAQ HISTORICAL PRICES